Reading the Tea Leaves: March 2025 Vail Valley Market Snapshot

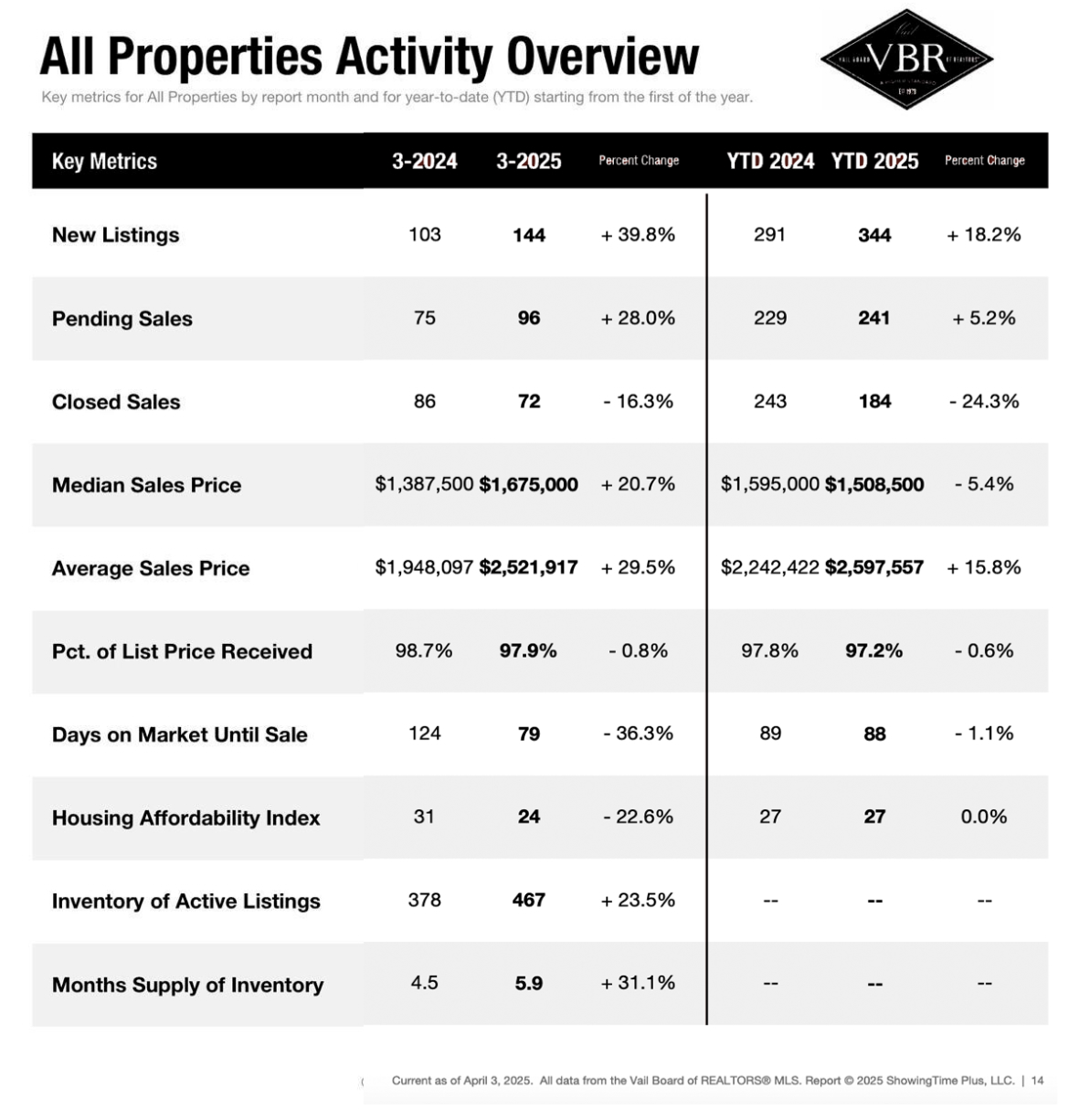

While pricing has held relatively steady in the Vail Valley, overall market activity remains quiet. Many buyers continue to watch from the sidelines, and even those actively touring homes appear to be in a holding pattern. Although the average Days on Market for March dropped to 79 (from 124 last year), it’s important to note that this figure only includes properties that have closed—not those still active or under contract. A more complete picture would factor in the many listings still sitting on the market, often well beyond that average.

Closed sales and overall transaction volume have declined significantly year-over-year, with a 24.3% drop in year-to-date closed sales. Despite this, average sale prices are up 15.8% year-to-date, suggesting that sellers are holding firm on price. Inventory has seen a slight increase (+18.2% YTD new listings), but remains well below pre-COVID levels, keeping pressure on supply.

That said, sellers who have properties in rare, highly sought-after price points or configurations are still seeing strong demand—and in some cases, quick sales. For everyone else, pricing attractively or exercising patience remains key. The Vail Valley is a unique, small market—rarely yielding truly statistically significant data—but the current indicators suggest that while values are holding, the pace of sales has slowed.

This all comes amid a broader environment of national change, with ongoing shifts in U.S. fiscal policy—including government spending cutbacks, tariff adjustments, and other economic measures that can influence consumer confidence and investment behavior. Markets historically favor stability, and real estate is no exception. While we wait to see how these dynamics unfold, buyers are experiencing a rare window of opportunity: for the first time in a while, there’s less pressure to move at lightning speed, and we’re beginning to see the return of negotiation leverage—including, in some cases, the ability to include loan contingencies. If conditions stabilize, the market may come roaring back with a vengeance.

And let’s not forget what happens every year as temperatures rise: our market tends to heat up right along with them. Texans, Chicagoans, New Yorkers, Floridians, and Arizonans all seem to hit that familiar moment in late spring or early summer where they realize—yet again—that they wish they’d bought something for the season. It’s a pattern we see year after year, and every summer buyer says the same thing: “We should have done this sooner.”

The March 2025 Vail Valley real estate market appears to be in a season of transition. Sellers are still achieving strong prices, but buyers may be gaining more negotiating room. Whether this leads to a more balanced market or simply a slower-paced, high-value one remains to be seen—but the tea leaves are giving us clues.