WHAT YOU NEED TO KNOW

Property owners throughout Colorado, including in Eagle County, have received their 2023 Real Property Notice of Valuation for property taxes, and the values have soared. This spike in property valuations has caused concern among property owners worried about property tax increases that may accompany their increased property valuations. The purpose of this article is to provide you with information on how Colorado’s property taxes are calculated, whether your property taxes are likely to increase in line with your valuation, how to assess the accuracy of your property valuation, and when & how to file an appeal. There is a bunch of “do it yourself” help in here with video tutorials. Still, you can ignore all of that if you don’t want to handle it on your own and want a general understanding and to hire someone to handle it for you, such as the appraiser or attorney I provide at the end of the article.

Property owners who have not received their Notice of Valuation should contact the Assessor’s office to have it sent to you and to verify that your address is correct, as they were mailed on May 1, 2023. Phone: 970-328-8640 Email: [email protected]. You can also immediately retrieve the data from the Assessor’s website, but best to get your official notice.

UNDERSTANDING THE EAGLE COUNTY PROPERTY VALUATION PROCESS

First, let me explain that we are incredibly fortunate to have a fantastic Assessor’s office in Eagle County. I am not just saying this, they are genuinely remarkable. I speak with people from the Assessor’s office fairly regularly in my business. They have a level of hospitality that is shocking these days, even in the private sector, and is a small miracle in the governmental world. So don’t be afraid to call them, they are there to help. Another thing to keep in mind is the Assessor’s Office only values the property, they do not determine the actual taxes or mill levies. They also encourage you to protest when it makes sense as they realize this is a very general assessment process and that there are known and unknown details that make a difference. They take no offense to a protest of a valuation and want valuations to be fair. You should know that if your valuation is determined to have inaccuracies during a closer evaluation, they will correct it in whatever manner (up or down), so I would consider that before automatically protesting the analysis.

THE PROPERTY VALUATION PROCESS

Your 2023 property taxes for Eagle County will be payable and collected in 2024, as property taxes are collected one year in arrears in Colorado. Each year, the Assessor is mandated by Colorado Statute to notify you of the value of your real property, a figure which will serve as the basis for your annual property taxes. This valuation is only part of the equation, as your actual property taxes cannot be determined until the tax rate (mill levy) is set for each taxing entity. that applies to your property

So property valuation is only the first step in the property tax process. The way the Assessor values each property is by using the market approach, mandated by Colorado law for residential and land property types. That means that comparable data from prior sales is used to establish the value and they use the 24-month period ending June 30th of the year prior. If the amount of sold data is insufficient for your property during this time period, Assessors may use data from the 5-year period ending June 30th; however, most people will see comparable sales within the 24-month period from July 1 through June 30 (this year that means July 1, 2020, through June 30, 2022). If there were not many sales in your neighborhood for any reason, then they will branch out to the super neighborhood or other super neighborhoods before going beyond the 24-month period, particularly at a time of a huge change in values, as there has been in the last several years. Either way, they will ensure at least 30 comps for this process.

After reviewing comparable sales, the Assessor will adjust the subject property to match the timing of the comparable data, compensating for any differences in market conditions (inflation, or deflation) between the date of the comparable sales and the date of the appraisals used, June 30, 2022. The details of this are not public nor on their website, but it is fairly detailed modeling for the comparables that are used to value your property.

PROPERTY TAX CALCULATION

This is the formula to calculate your property taxes:

Assessed Value x Tax Area Mill Levy = Property Tax Amount

For the tax year 2023, the assessment rate for residences is 6.765%.

The mill levy for a property adds up all the mills from each entity that has the authority to tax your property for a total mill levy for that property. See the example calculation below. You can actually look up the mill levy for your property: Here is a video. In this case, it will be the 2022 mill levy until the 2023 mill levy is set and updated on the website in December 2023 or early January 2024.

Example:

Actual Value $600,000

Single-Family Residential Rate x 6.765%

Assessed Value $40,590

Once the mill levy is determined, that is multiplied by the Assessed Value to get the amount of the property tax.

Note: Renewable energy & agricultural property is assessed at 26.4% and, generally, all other property (including commercial/industrial and vacant land) are assessed at 27.90% (based upon Colorado Revised Statute 39-1-104).

HOW TO DETERMINE IF MY TAXES ARE LIKELY TO GO UP AND BY HOW MUCH?

To know if the 2023 property taxes that you pay in 2024 will increase, one of the following occur: (1) A new entity has a right to tax you (unlikely and you would likely be aware); (2)The tax entities that have a right to tax you each year increase their budgeted revenue they plan to collect in 2024; and/or (3) Your property valuation increased by more than the other properties that are also responsible for that tax in your tax area such that you are going to pay a larger slice of the pie.

Although your property value may have increased substantially, it is unlikely that your taxes will increase by the same percentage because all property values increased and many of the tax entities that tax your property will not be increasing their revenue by as large a percentage as your property value increased. Having said that, no one can confirm your exact property taxes until after each taxing authority solidifies its revenue for 2024 and the mill levies are set.

HOW TO KNOW IF TAXES ARE LIKELY TO GO UP BEFORE THE MILL LEVY IS ACTUALLY SET?

You can research and find out who your tax entities are and if they plan to increase revenue, or if those entities are even allowed to tax beyond inflation and growth factors. Some property tax entities have restrictions on increasing their revenue due to The Tax Payer’s Bill of Rights law (“TABOR”) or other voter-approved limitations. This can substantially minimize the impact of the increase in property values as mill levies must come down if the revenue isn’t changing much given that mill levies are based upon the amount of revenue being generated and are not actually based upon property values. Although some tax authorities have been granted a full or partial exemption from TABOR limitations, there are still certain entities constrained by ballot measures. Additionally, some tax entities are actually conscientious and try to avoid increases in revenue requirements that are not necessary.

A recent article in the Vail Daily talked about several different key tax entities in Eagle County and their plans for property tax revenue increases in the upcoming year. The Vail Daily reported that one of the largest tax entities, the Eagle County School District, recently stated that there wouldn’t be a significant increase in revenue for the district due to funding ballot measures that require they drop the mill levies when property values go up. Obviously, any tax entity can also attempt to appeal to the voters to increase taxes between now and December. In the Vail Daily article where one fire district notes that they will be asking the voters to approve an increase in revenue for them for capital improvements needed, the district subsequently canceled that vote. Here is a link to the article here discussing the cancellation of that vote.

To get an idea of your specific property tax increase you can determine who your taxing entities are, then gather any known information from articles like the one in the Vail Daily, then call any of the other taxing entities and ask for their planned budgets for 2024. For instance, in my Tax Area where my home is located in The Cordillera Valley Club, there are 11 taxing entities. The Vail Daily article already mentioned the plans for four of them, so I can now call the remaining entities and ask about their revenue plans as well. This will give me a better idea of what to anticipate from them about whether they plan to increase their revenue next year or have any plans to ask for a vote to increase taxes.

HOW TO GET A LIST AND CONTACT INFORMATION FOR THE ENTITIES THAT TAX YOUR PROPERTY?

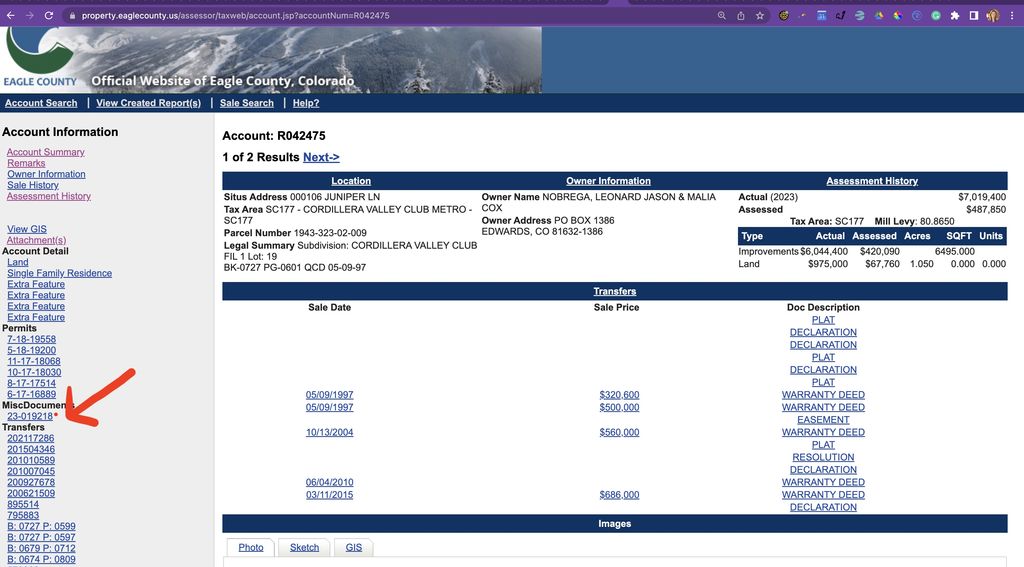

To determine the exact entities taxing your particular property and their contact information, you can get that information from the Eagle County Assessor’s website in the Appeals section area by clicking here to view and download an Excel spreadsheet. You can then filter the list by your specific property Tax Area. Your Tax ID can be retrieved from your Property Record Card on Eagle County’s website. See the example screenshot below from a Property Record Card search, and you can see the Tax Area is highlighted in blue, or click here to see a short Youtube video that shows you how.

You can also determine the percentages of each tax entity with taxing authority in your Tax Area by locating your property on the Eagle County Assessor Tax search here. Once you locate your property using your name or R number (the address is a bit wonky to use when searching here for some reason, so use your name or R number if you can), you then click on “view unpaid bills” and then click on “where are my 2022 taxes going.” If you don’t see the “where are my 2022 taxes going” it seems to me that once the taxes are fully paid, this link goes away for some bizarre reason. You can always get the same data from one of the neighboring properties as they are in the same tax area, so the amounts will change but not the percentages. Or the assessor’s office would be happy to provide it if you email or call them once you open that you can highlight all of it and copy and paste that data into a spreadsheet to calculate the percentages for each entity. Click here for a Youtube example of how to do it.

HOW MUCH DID YOUR PROPERTY VALUE INCREASE IN COMPARISON TO OTHERS WITHIN YOUR TAX AREA?

The other important factor as to whether your increased valuation will mean higher taxes for you is whether or not your property increased in value more than the average of the other properties within your tax boundaries. To put it simply, if your property value increased more than the average property increased in your Tax Area, then you’ll have to pay a higher portion of the tax. On the other hand, if your property value didn’t increase as much as others did in your area, then your tax percentage may reduce. You can ensure your fair property valuation by checking your property value for accuracy and appealing its valuation to the Assessor, if necessary. I don’t believe that the Assessor offers data about this for each tax area but I find that you go to the Eagle County GIS and get a feel for other properties in your neighborhood to see if it seems “in line” with others that you know. Click here to go to the Eagle County GIS and search for your property. I like to click on “parcels” in the layers and change the base map to “imagery with layers.” This makes it much easier to view and know what property you are clicking on visually. You can do this by clicking on the upper right-hand corner options on the GIS webpage. Here is a link to my video showing how to gather data using Eagle County GIS.

SHOULD YOU TAKE TIME TO REVIEW YOUR TAX VALUATION, SHOULD YOU APPEAL, AND, IF SO, HOW AND WHEN?

SHOULD YOU TAKE TIME TO REVIEW?

If you plan to sell very soon, you may be better off letting it go. It might help future buyers feel confident in your sales price and not mean a huge expense increase. By all means, if it seems high, absolutely take the time to review and potentially appeal. The Eagle County Assessor’s office is in the process of evaluating more than 60,000 properties. This is obviously a challenge due to the project’s scope, how frequently it occurs, and the fact that our county has properties located immediately adjacent to each other that can have vastly different property values. The methodology being used may not be able to determine all variations in value with this mass approach accurately. Additionally, it heavily depends on property owners giving accurate data and they often do not as there is no requirement to do so and no one likes to participate in something that causes their taxes to increase. There are many ways that the data can be inaccurate and if you establish those inaccuracies, then it will likely result in a positive appeal outcome.

You should inspect the Assessor’s records related to your property as well as the comparable properties that were used in your valuation, and consider whether it makes sense to file an appeal if you find errors or inaccuracies. Records on land and buildings are public information; therefore, you have the right to examine them, and the Assessor’s office can provide helpful information both online or if you contact their office directly.

WHAT IS NEEDED FOR A SUCCESSFUL APPEAL

To successfully appeal, a property owner must provide evidence of sales details from the subject property or comparable properties to prove inaccuracy, provide information to correct property details that the Assessor may not know, and/or provide an appraisal dated within six months of June 30, 2022, which highlights a discrepancy from the valuation. In speaking to key personnel at the Assessor’s office this year, during an appeal, the assessor’s office will look for the most comparable properties to the property being appealed. That may require going outside of super neighborhood or neighborhood boundaries in certain circumstances. Ultimately, they are trying to mimic the motivations of a typical buyer in the market.

CHECK THE DETAILS ABOUT YOUR PROPERTY

You will need your property record card to get the data to check for your property from the Eagle County Assessor website. Click here for a video of how to retrieve this. Once you have retrieved this information, check the valuation date condition if you have recently been building or did major remodeling. They value a property’s condition as of January 1, 2023, but that is only relevant to the condition and use. So if you are new construction or are torn apart for a remodel, make sure that you bring this to their attention as it can affect value. Make sure they have the right condition of the property as of January 1st and at the right level within their parameters.

Pay particular attention to the accuracy of sizes and quantities listed for your property (i.e. how many bathrooms and bedrooms, lot size, etcetera), and whether the building quality code and depreciation level seem accurate.

The Assessor’s website also describes how the Assessor comes up with the effective square footage they use in their calculation for each property, so review your square footage for accuracy. Also, you need to check the building quality code assigned to your property which is based on things like the quality of the workmanship, the type of materials used, and the design. It is important to note that you can have an excellent quality for a home due for a remodel as this is reflected in the depreciation and not the quality factor. In other words, if your house is the highest quality built at the time and continues to have the highest quality, but is very old and outdated, your quality will still reflect the high quality from when originally built. However let’s say that in your area when first assessed you were considered high-end workmanship but then the area substantially moved into a higher echelon of quality, you might actually reduce in quality. But a reduction isn’t related to age, but rather the increase in the quality of the neighborhood overall.

BE CAUTIOUS AS THE VALUATION CAN INCREASE IF YOU APPEAL

One crucial fact/warning to mention is that if you appeal your tax valuation, the Assessor’s office will very likely come out to inspect the property as part of that process. Thus, keep in mind that if you have found inaccurate data that you feel will reduce your valuation, you also need to consider if there is anything inaccurate in the report that will increase your valuation if known by the Assessor (and therefore increase your taxes). The Assessor can and will increase your valuation if they determine that their data is inaccurate and, once corrected, ends up increasing the market value of the property. For example, property owner A notices that the building quality code is excellent for his property when he knows that the home was not the highest building quality even when built and has even tapered off with the quality of homes added to the neighborhood. He appeals the valuation and someone from the Tax Assessor’s office comes out and determines that the property building qualities are not accurate but that the tax records show 3 bedrooms rather than 4 bedrooms and there is missing square footage from an addition that was never updated in the Assessor records. In this scenario, you may end up with a higher valuation.

CHECK THE COMPARABLE SALES DATA AND THE ACCURACY OF THE ASSESSOR DATA COMPARED TO REALITY USING THE VAIL MLS

Now that you have checked the details and statistics for your property it is time to check how comparable the used comparable sales are to your property.

Checking the accuracy of the comparable data can also include seeing if the data that the Assessor has for that property in their database matches reality. Did that property only have 3 bedrooms that you are being compared to or did it have 5 because the basement was finished and the county data was inaccurate because the owner didn’t want to correct it and increase their taxes? Have your trusted Realtor send you the comparable data from the MLS for all the comp sales available for your valuation and see if they match up with the Assessor’s comp data. Although property owners are not quick to correct errors with the county Assessor that could result in increased taxes, you can bet they are bragging about every square foot and detail in the Vail MLS system when selling the property.

How comparable is your property to the others sold? Are you in a nicer part of the neighborhood or are the comps? The greater the differences in your property to the comparables the greater the probability of there being an error in quantifying the market adjustment for that difference. Additionally the more varied the comparables are from one another, particularly in price per square foot, the more likely there could be an error, so specific comparisons within the neighborhood may be warranted. If you are one of the nicest locations and houses in the neighborhood, the chances are your appeal will not be as successful as if you are the least appealing home in the neighborhood. If you are the ugly duckling or the one next to the highway in the neighborhood, there is a great chance you should appeal as you are not likely to do well in a mass appraisal.

The Assessor also provides public access to comparable data for property owners on their website. You can also use this comparable lookup tool provided by the Assessor. Note that the comparable lookup tool only provides by default the comps nearest to your property and is not necessarily consistent with all the comps used by the Assessor, so you need to broaden the search out and pull the comps as outlined in the next paragraph. Also, the tool linked in this paragraph has not yet been updated and so is from the last assessment period, but the Assessor’s office indicated it would be updated soon.

The best way to find what comps the Assessor is using is to click here for comparable data on their website, then select the type of property, then filter by Superneighborhood, and finally filter by Neighborhood for your particular property. Click here for a YouTube video demonstrating this process.

You then want to compare the comp data that the Eagle County Assessor has provided you and compare it to the data that is available on the Vail MLS. Contact your trusted real estate advisor in the area who will be happy to help provide you with comparable data. If I am your real estate advisor in Vail or you don’t have one, I am happy to provide you with any MLS data of the comparables for your property so that you can compare them to the Eagle County Assessor comps. As you can imagine, there is much more information/media about properties on the MLS than in the Assessor’s database.

When reviewing the data between the Vail MLS (or Aspen MLS for Eagle County residents that the Aspen MLS covers), compare carefully and pay particular attention to if the source of the MLS data for the square footage is not the Eagle County Assessor because an agent would almost always use the County’s data unless it was inaccurate or misleading in some way.

THE PROPERTY TAX APPEAL PROCESS, DEADLINES, AND FORMS

Now that you have several inaccuracies to report and are being compared to gorgeous properties in great locations when you are the ugly duckling home, it is time to file an appeal. If you decide you have the bandwidth and skill to handle it yourself, you can easily submit your appeal online. If you do not wish to submit online or in person, you may also use USPS, FedEx, UPS, or fax. To preserve your right to protest, your mailed protest must be postmarked no later than June 8, 2023, and you must have proof of timely filing. If you disagree with the Assessor’s determination on your appeal, or if you do not receive a Notice of Determination from your appeal, you must file a written appeal with the County Board of Equalization on or before July 15, 2023.

Mailing Address: Eagle County Assessor, P.O. Box 449, Eagle, CO 81631-0449, Fax: 970-328-8667 online form.

The Eagle County Assessor’s staff offers free assistance, but if you’re not satisfied with the market value and don’t want to file an appeal on your own, you can contact an appraiser or a local attorney who does tax evaluations, protests, and appeals. They can help review your property and decide whether protesting is a sensible option. If you appoint an agent to act on your behalf, that person must have your written authorization to proceed on your behalf with the Assessor.

You should consider your potential savings against the cost and effort of getting help before making this decision. If you intend to live in the property for a long time, correcting the valuation could have a lasting impact. For me, the property valuations have always been “close enough”, or even undervalued, so I have not used these resources in the past. But I have been involved with helping clients with this process for many years by referring them to a local law firm or appraisal company.

Pack Appraisal is a local appraisal office helping with tax appeals. Their website has a lot of information about the process of evaluating, protesting, and appealing your tax valuation. They are slammed, as you can imagine, and asking people to review information here first before calling them.

Stovall & Associates in Edwards has also been involved in the evaluation, protest, and appeal process over the years and you can contact them through their website to learn more information. They will also provide you with a letter about the process and their price structure.

Also, feel free to call me with any comments or questions. I can be reached at 970.977.1041 or [email protected].

Malia Cox Nobrega is a luxury real estate agent in the Vail Valley in Colorado. She has consistently ranked in the top three individual producing agents in Eagle County for the past few years and was recently named the #14 producing individual agent in Colorado for 2022 by Real Trends & America’s Best Real Estate Agents. Malia is a non-practicing attorney licensed in the State of Colorado and formerly owned a large property management company in the Vail Valley before becoming a full-time real estate agent in 2014. Malia provides individual and tailored service to her clients and is known for her intelligence, work ethic, integrity, and achieving exceptional outcomes. You can learn more about Malia on her website at vailluxurygroup.com.